Paul Nusca – Salesperson at Berkshire Hathaway HomeServices

Register to get content like this sent straight to your inbox.

Register below.

Receive the latest posts on this topic, automatically.

Purchasing Abroad – Italy with Marcus Benussi

———–

About Marcus

What are the typical transaction steps for a foreigner buying a property in Italy?

The first step is to search for property either privately or through a real estate agency.

Next, is due diligence (certificates, authorizations, permits, acts of provenance, deeds, etc…) which is normally performed by a real estate agency or lawyer.

Once a final decision to purchase a property is reached, the buyer and seller sign a preliminary purchase agreement and a deposit is due (either bank-guarantee, cheque or a wire-transfer to notary’s fiduciary account). Normally the amount of this deposit is between 10 and 15%.

Then comes the application for personal “Codice Fiscale“ (Social fiscal number/equivalent to US Social Security Number) – Mandatory for the buyer; This application can be done at the local tax offices (Agenzia delle Entrate) or through the appointed notary for the final purchase agreement.

Notary appointment for final deed (the presence of a lawyer on the buyer’s side is not mandatory but highly recommended).

The final step is to secure the proof of final money transfer, either through notary account, bank guarantee or cheque.

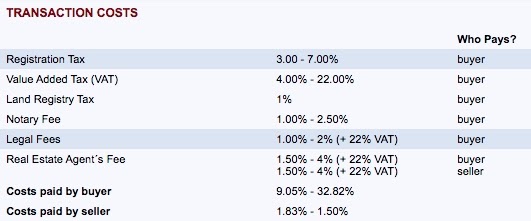

How are the funds processed, and what are the typical fees associated with purchasing?

A bank account in Italy is not mandatory, but recommended. In the latter case, a bank account can be issued at any bank in Italy, provided that the reason for opening a bank account is to purchase property.

Once the bank account is opened, the origin of incoming funds from abroad eventually needs to be justified (retirement/pension fund, disinvestment, inheritance, etc.). An Italian bank account is highly recommended in order to provide for all expenses related to the purchase agreement and all further refurbishment expenses or local municipality fees and services (electricity, water, garbage, etc.). Foreigners can get mortgages in Italy, as long as they can provide proof of financial guarantees, fix income and/or cash (see the breakdown of the costs below). NOTE: Overseas loans are granted through some US banks, as well. I strongly believe the same applies to Canadian banks as well.

What are the most common areas for investors to purchase property in Italy?

Real estate prices have fallen the past 10 years in Italy. Exceptions were in the high-end and luxury markets in prime locations. Today, these markets have grown back to normal, due to the increasing demand of such real estate, especially from neighboring EU countries.

The Italian market needs to be analyzed according to the different markets: Milano is a market of its own and has grown enormously in the past 5 to 10 years. The market in Rome is developing fast and is second to Milano. These are the two main big cities where investments are increasing and demand is much higher than the actual offer.

Furthermore, Italy has a relatively small surface: the UNESCO heritage mountains (Dolomites) are a couple of hours away from Venice and its beaches. Milano is a couple of hours drive from Portofino and the Ligurian coast, including Monaco, the Cote Azur and the Tuscanian coast and countryside. These areas are all very well known and this is the moment for the best deals!

What are the top 5 areas in Italy where people are buying?

- Tuscany (Florence, Siena, the hills)

- the countryside south from Piacenza and Milano (towards Liguria): the world-famous “Food Valley“

- Abruzzo and Puglia macro area: the entire coastline from Pescara to Gallipoli are among Italy’s most wanted locations

- Rome, the eternal city: from one-room apartments to large apartments with unique views in prime locations – an excellent lifetime investment

- Milano, the world center for fashion, architecture and design, and at the moment, the best investment in Italy.

Up and coming neighborhoods are: Milano (Porta Nuova area), Abruzzo and Pescara coast, Ligurian Coast (except for the already world-famous locations such as Portofino and Cinque Terre).

What about the taxes?

It’s important to note that Italy can be a tax haven! The €100,000 flat tax regime is an elective regime for new residents of Italy, and the flat €100,000 charge substitutes any income tax payable on foreign income and assets. You will not pay any:

• Income tax

• Regional surcharge

• Municipal surcharge

• Capital gains and dividend tax

• IVAFE – Wealth tax on foreign financial assets

• IVIE – Wealth tax on foreign real estate

As a buyer, you need to pay the flat charge once per year on/before June 30th of the following year. Let’s say that you opted for the flat tax regime during the 2020 financial year, you must:

• Pay the €100,000 charge on/before June 30th 2021

• File your tax return on/before November 30th 2021

The election lasts up to 15 years and the taxpayer can exit at any time without incurring any clawback from the tax office. The €100,000 charge does not include any income made in Italy. In this case there are other favourable tax regimes for new residents in Italy.

Who can qualify for the Flat Tax Regime?

In order to qualify you must not have been a tax resident of Italy for 9 of the past 10 years and apply to treat your foreign income under the flat tax.

There is no nationality requirement to benefit from the €100,000 Flat Tax and all you have to do is become a tax resident of Italy, file your taxes regularly and pay the flat tax in one lump sum every year.

In 2017, new residents were required to submit a probationary ruling to the tax office in order to opt for the regime. This requirement was withdrawn the year after. Despite not being mandatory, we strongly encourage you to submit the probationary ruling prior to applying for this regime because it greatly reduces any possible challenge the tax office might claim later on as they already provided a green light to your application.

Finally, the flat tax fits well with the investor VISA program to Italy. Family members can also opt in as long as they meet the residency criteria. The only difference is that any family member will pay only €25,000 per year instead of €100,000.

Is there any other tax covered?

The Italian flat tax also covers any inheritance and donation tax payable in Italy. During the 15 year election period, the taxpayer can donate assets to individuals and trust without incurring in any tax charge in Italy.

Imagine that you lost your US domiciled status and you wish to transfer your assets to your children or to a trust. You can use this regime to avoid any further tax charge in the US and in Italy. Other countries do not levy any inheritance or donation tax if the donee is a non-resident, therefore this regime can be an extremely useful estate planning tool.

When is it actually convenient?

Let’s do some math.

In order to have a tax charge of €100,000, your annual taxable income must be around €250,000 from any sources (employment, dividends, capital gains, rentals, etc.). If you own foreign assets you must account for the 0.76% of any asset value per year, which makes it more convenient. A €1,000,000 investment portfolio generates an annual wealth tax liability of €7,600!

Evaluating the convenience of this regime is a matter of a combination of income tax, inheritance tax, and wealth tax. You would be surprised how this regime fitted individuals whose wealth is not unbelievably high. Is the flat tax always the best option? It depends! The law allows the taxpayer to cherry pick the income sources you would claim for your €100,000 tax, it comes natural that some foreign sources can be excluded and be subject to the Italian taxation.

Why would you use it?

Sometimes, some sources of income are not taxable in Italy based on the double tax treaty between Italy and the foreign jurisdiction. If they are taxable but you can claim sufficient tax credits to minimize the tax burden to 0 it makes sense to exclude the election as you avoid wasting any available tax credit. There can be other reasons to exclude the flat tax election.

Nonetheless, these calculations require good planning and an ad hoc strategy to make it effective, and avoid any claim from the tax office.

Looking to buy abroad? We can help.

Complete the form below to be connected with an international partner.

Error: Contact form not found.